By 2025, more than half of venture capital funding will rely on smart tools to find, evaluate, and grow startups. This is changing the game for investors. Venture capital is no longer only about intuition or luck. Investors now need smart strategies to stay ahead.

Startups are appearing faster than ever. Markets are changing quickly. If you rely on traditional methods, you will miss opportunities. Smart tools help investors act faster, make safer decisions, and spot trends before others do.

In this guide, you will learn the five most important deal insights for VCs in 2025. These insights are practical, actionable, and easy to understand. We also include examples, using processes, and suggested tools for each insight to make it easier to apply.

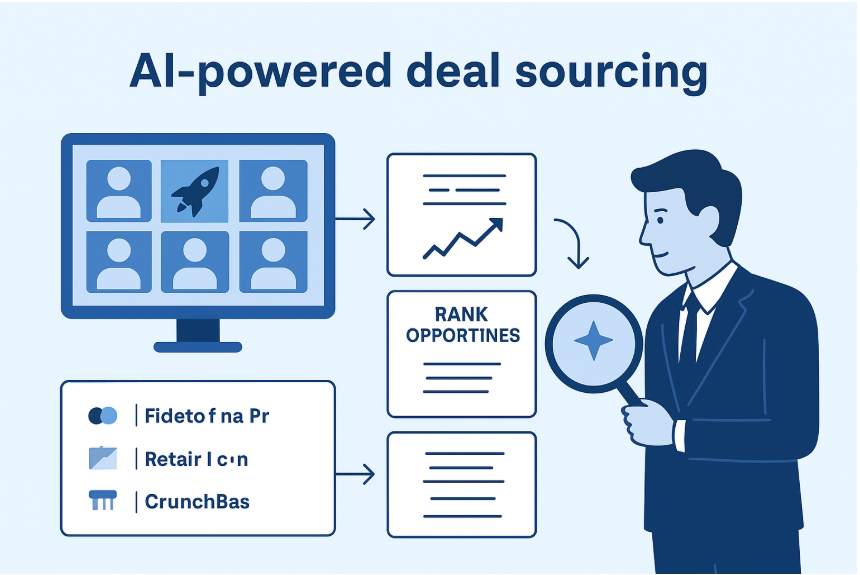

AI-Powered Deal Sourcing

Finding the right startup is the hardest part of investing. There are thousands of startups every day. Not all of them are worth your time. AI-powered deal sourcing helps investors find the best opportunities quickly.

Why Deal Sourcing Matters

Many investors rely on contacts or old networks. This will stop you from missing out on hidden scopes. AI-powered Deal Sources lets you sift through hundreds of deals and choose the perfect deal. If you broaden your search, you might find a company that no one else has noticed.

How It Works

-

Find growth target: Find startups with quick success or dynamic products. Track growth data like user adoption, monthly profit, and market share.

-

Rank opportunities: Score startups based on market size, members, and stress. Build a numbering sheet with all criteria, such as market size (40%), team experience (30%), and traction (30%). Treat it like making a shortlist of the top players-you want the strongest prospects first.

-

Identify the market gaps: First need to find where demand is high but supply is low. Using AI tools easily research market trends, competitor information, and unmet customer requirements. Empty niches always hide the most promising startups.

Suggested Tools

-

PitchBook: For tracking startups and funding rounds.

-

Crunchbase: To find new startups and analyze trends.

-

Dealroom: For industry information and company analytics.

-

Affinity: Helps manage networks and prioritize deals.

How to Use It

-

Monitor startups continuously from multiple sources using AI.

-

Focus on the best scopes.

-

Find the areas that others avoid.

Tip: Smarter deal sourcing saves time and helps you find hidden opportunities.

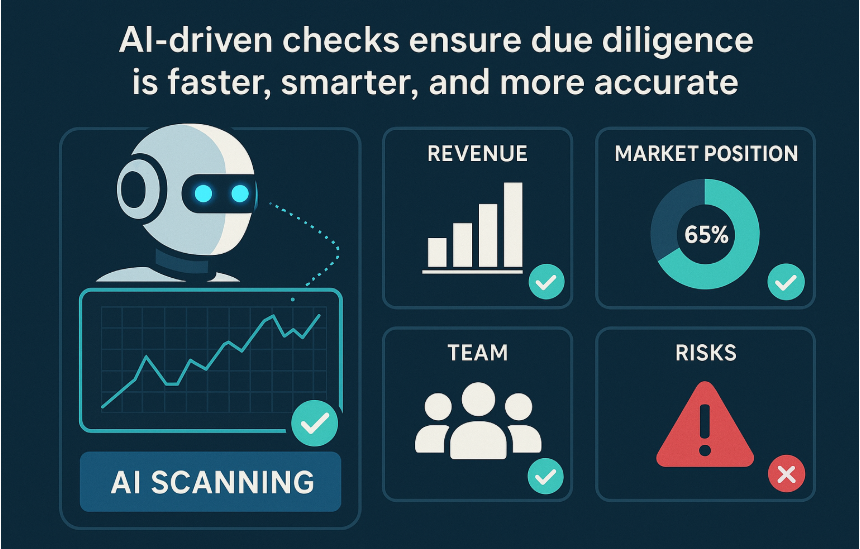

AI-powered smart checker

Once you find a startup, you need to check its details. This is called due diligence. Old methods take weeks. They can miss hidden risks. Faster, smarter AI checks make the process faster and safer.

What to Check

-

Economical: Revenue, prices, success patterns. AI research profit margins, cash flow, burn rate, and past funding rounds. Comparing to market benchmarks helps identify the best startups.

-

Market position: How strong is the startup compared to competitors? AI analyzes market share, adoption rates, partnerships, and reviews. Understanding the competition gives you an accurate picture of potential success.

-

Team: Are the founders capable and experienced? AI checks experience, references, and team stability. A good team can turn a small idea into a big impact.

-

Risk factors: Debt, Legal issues, or slowing growth. AI evaluates regulatory compliance, intellectual property, and legal risks. Finding these quick decreases in costly mistakes.

Suggested Tools

Carta: For analyzing cap tables, ownership structures, and legal/financial risks.

Visible.vc: For monitoring financial performance and risk metrics.

How to Use It

-

Review startup data carefully before investing.

-

Compare multiple sources of information.

-

Watch for patterns that show potential problems.

-

Use a checklist covering finance, market, team, and risks for consistency.

Tip: AI-Powered checks increase confidence and reduce mistakes.

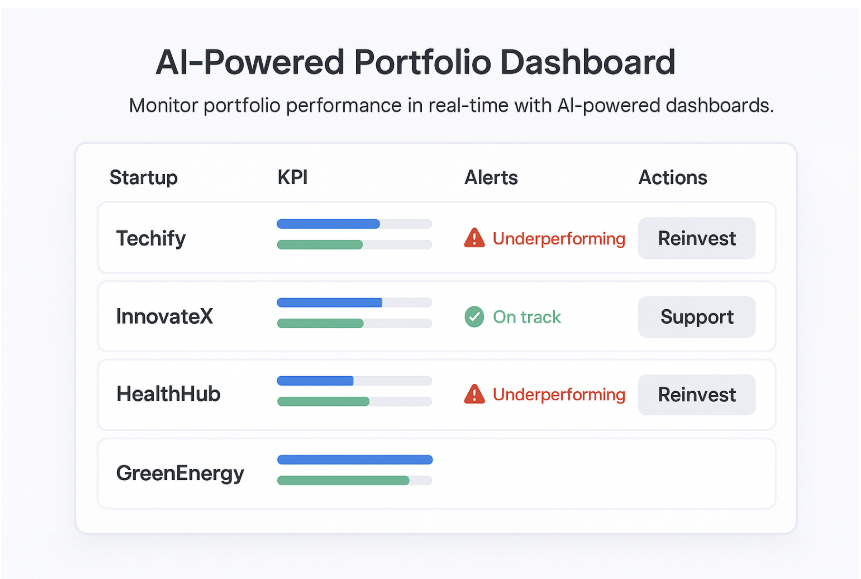

AI-powered portfolio Dashboard

Investing is not just about selecting startups. It is also about controlling them after the investment. Some startups grow fast. Others fall behind. Observe your portfolio closely to support you in making the best plans.

Why Monitoring Matters

Many investors check their portfolio only once in a while. This can manage to miss scopes or losses. Monitoring results continuously helps find scopes and risks early.

What to Track

-

Revenue trends: Is growth steady or slowing?

-

Market signals: Are competitors gaining ground?

-

Team changes: Are founders staying or leaving?

-

Follow-on opportunities: Should you invest more money in a successful startup?

How It Works

-

Collect data regularly: Collect monthly or quarterly reports on profit, costs, and success metrics.

-

Track market trends: Monitor competitor activity, sector growth, and emerging opportunities.

-

Analyze team performance: Check for key personnel changes or departures that could impact performance.

-

Find underperformers: Compare real result data against prediction data to identify startups that need attention.

-

Act on insights: Offer strategic advice, additional funding, or adjust support for startups showing potential or risk.

Suggested Tools

-

Visible.vc: For tracking portfolio performance metrics and generating dashboards.

-

Carta: To monitor cap table changes and ownership stakes.

How to Use It

-

Monthly, monitor your profile dashboard.

-

Look for underperforming startups early.

-

Reinvest in strong performers at the right time.

-

Use dashboards and alerts to track key metrics in real time.

Tip: Monitoring helps you protect your investments and grow returns.

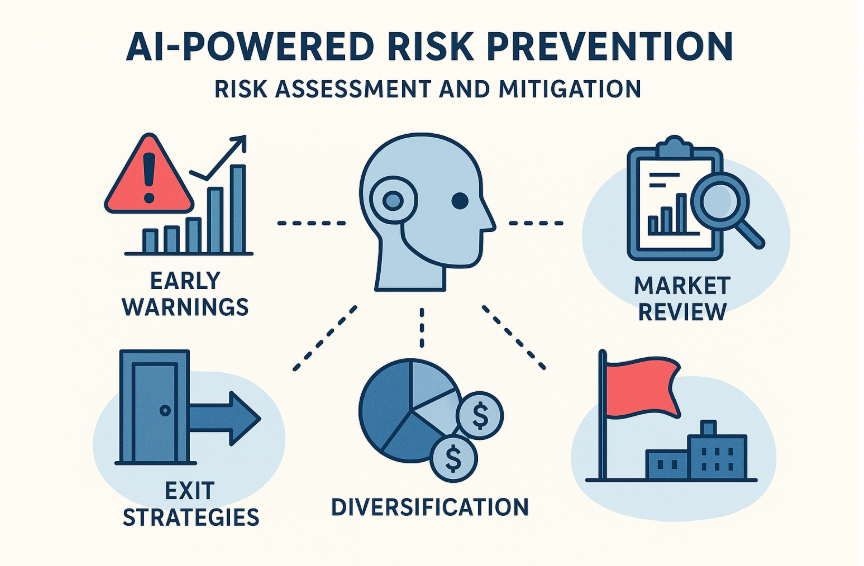

AI-Powered Risk Prevention

Investing always carries risk. Startups can fail. Markets can drop. Competitors can take over. Reducing risk is essential.

How to Reduce Risk

Early warnings: AI shows startups with warning signs.

Market review: AI checks whether the sector is growing or decreasing.

Diversify: Don't put all money in one startup or sector.

Exit strategy: AI suggests when to sell or when to prevent investment.

Suggested Tools

CB Insights: For sector trends, competitor monitoring, and risk analytics.

Crunchbase Pro: For early-warning signals like funding declines or executive changes.

How to Use It

-

Review startup, industry, and competitor data.

-

Take early action while the issue occurs.

-

Expand investments in various sectors.

-

Maintain emergency plans for every startup to prevent exposure.

Tip: Reducing risks saves money and keeps the portfolio stable.

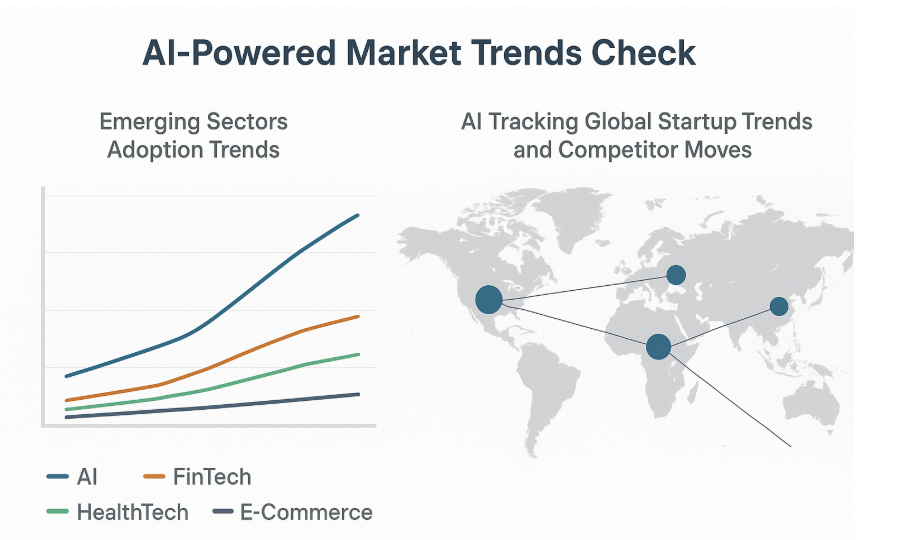

AI-Powered Market Trends Check

Knowing where the market is heading is as important as picking startups. Spotting trends early gives a big advantage.

Why It Matters

Markets evolve quickly. Startups that are hot today can be irrelevant tomorrow. Investors who spot trends early get a first-mover advantage. AI helps you invest in sectors before valuations rise too high. It also reduces the risk of backing ideas that are already saturated.

How to Spot Trends

Industry signals: AI collects all signals from news, patents, and startup activity.

Competitor moves: Collect competitor investing data.

Emerging sectors: Find areas with high growth potential.

Suggested Tools

-

SignalFire: For real-time trend tracking, startup signals, and market insights.

-

PitchBook: To monitor funding trends in emerging sectors.

How to Use It

-

Track growing sectors regularly.

-

Compare trends across regions.

-

Invest early in future markets.

-

Create a scoring system for trend opportunities based on adoption, funding, and market demand.

Tip: Early trend spotting helps you invest in sectors with high potential returns.

Conclusion

Instead, these five AI-powered insights, VCs can use a few extra methods to move forward. Networking helps find deals quickly and learn new trends. Learning from failed startups, what went wrong. And how to prevent mistakes.

Always updated with news, reports, and market trends, confirms you don't miss any scopes. Mentorship from experienced investors improves decision-making and confidence. Doing these things together helps investors stay competitive and make smarter choices.